Last night, a money manager friend of mine spilled the beans on her industry, and the truth is a scathing condemnation of money managers.

The bottom line? If you use a money manager for your investments, you’re getting screwed.

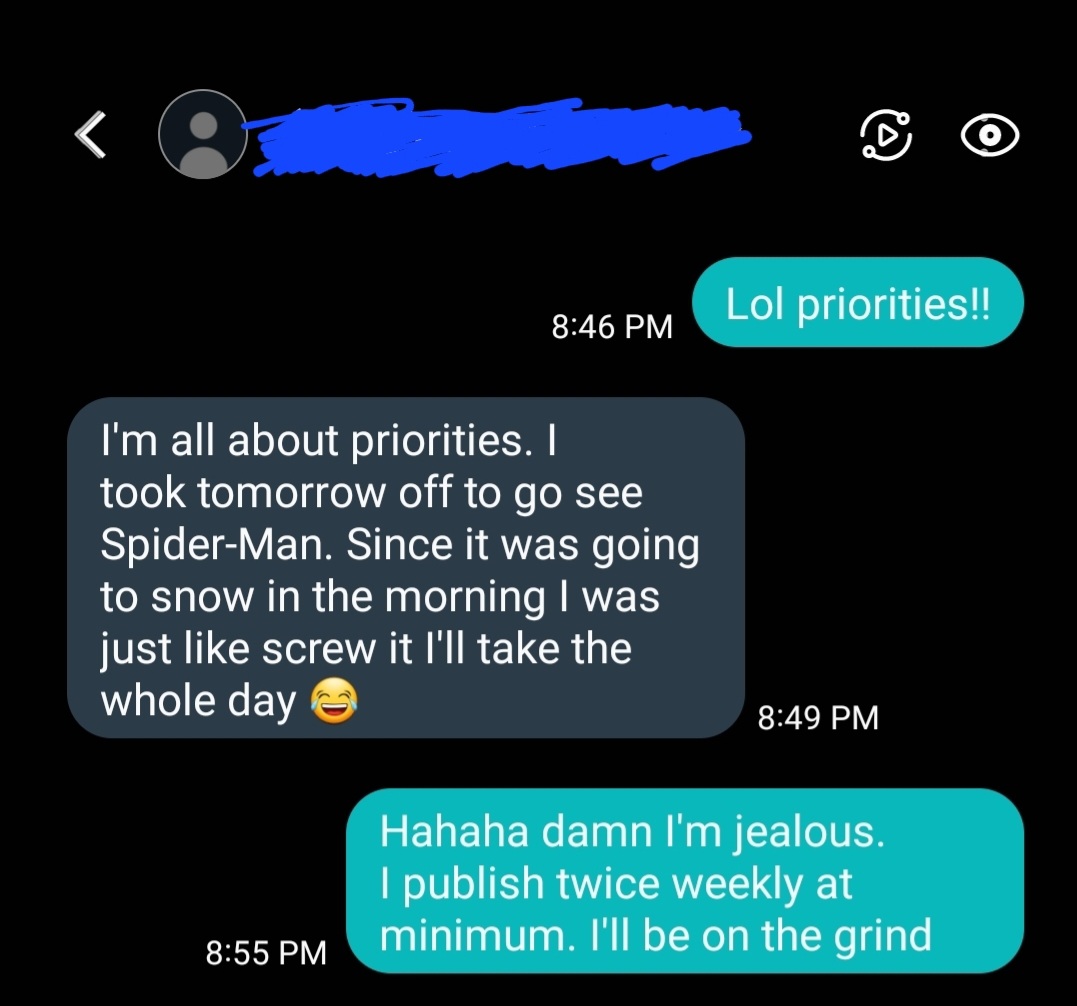

To start, while I’m here advising, researching, and writing up reports that produce huge gains relative to your average indexes’ returns, she’s at home getting ready to see the new Spider-Man movie for an afternoon matinee.

There’s no urgency or concern that the markets could be rolling over in Q1 and at the very least are rotating.

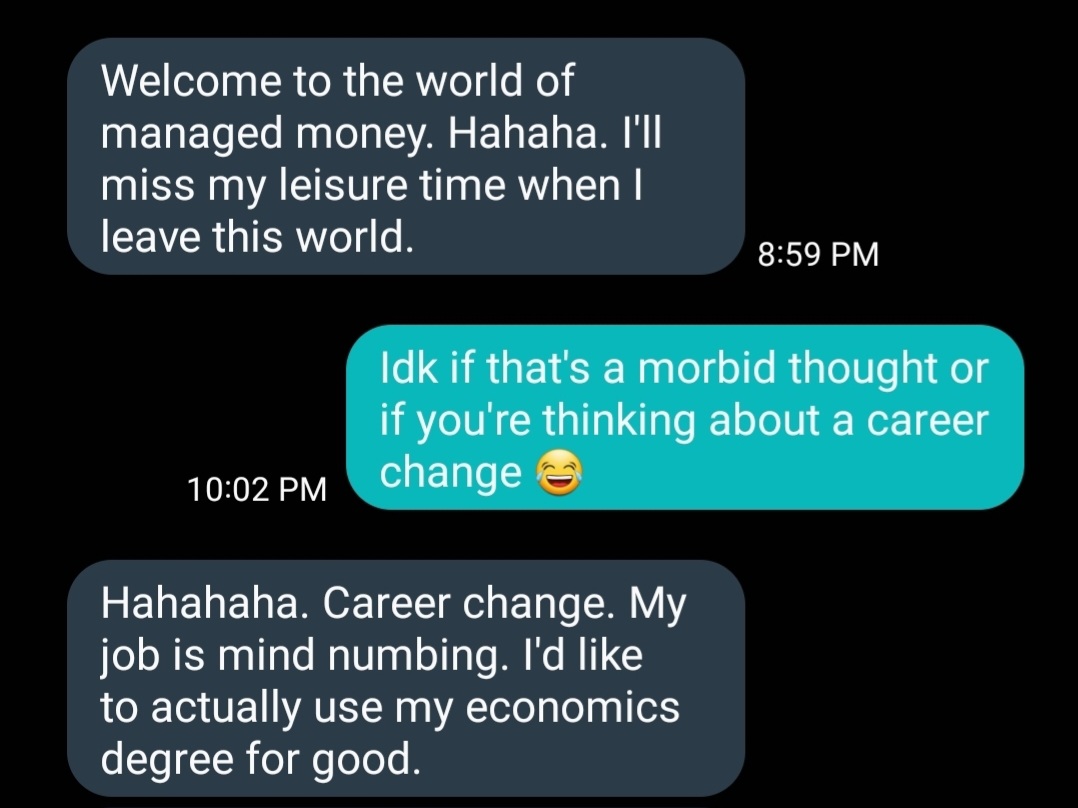

My other money manager friend is in Florida right now. I love the guy to death, but I can almost guarantee he’s doing more fishing and golfing than researching new trends for 2022 — trends that will produce returns higher than 10% in 2022, which is sadly the average benchmark of success for any standard money manager.

I love to fish and golf too — much more than picking stocks and options. But you and the rest of my readers deserve better. So I’m here, grinding for you, instead of laughing about how much money my company charges for our trades and maintenance.

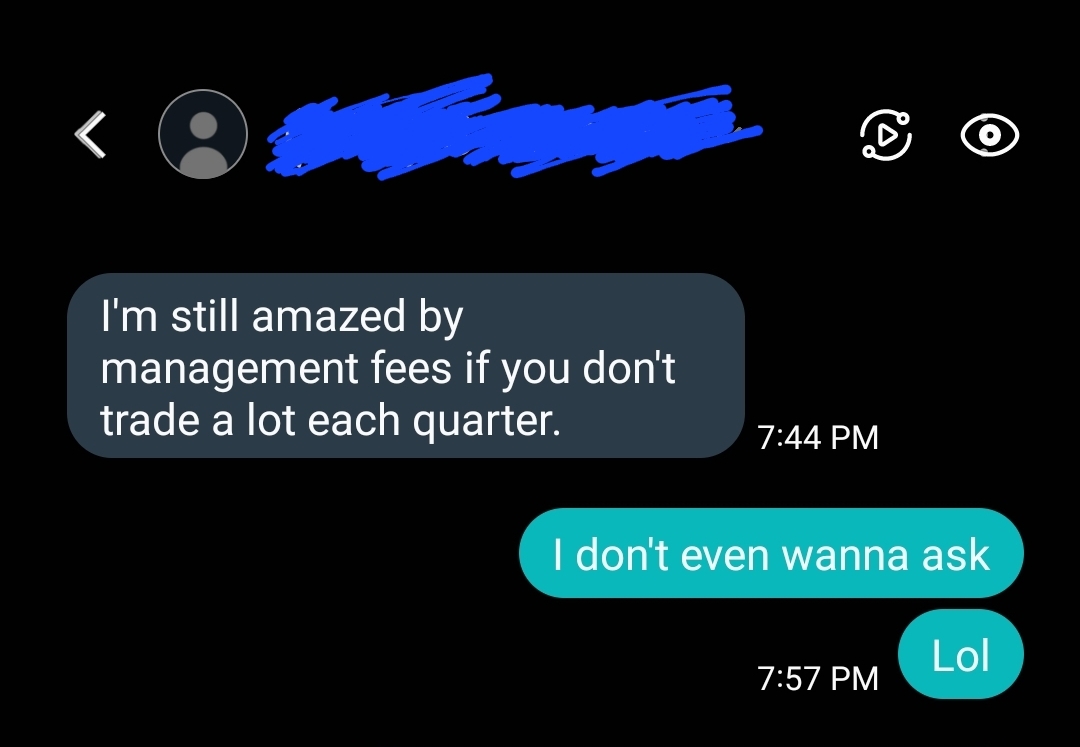

Which brings me back to the conversation I had with my friend. To protect her career and company (and not get sued myself), she shall remain nameless.

Now, don’t get me wrong — this money manager is really good at picking stocks. But I was aghast at what she told me next:

I’m a pretty good judge of character, and I know this money manager is a good person. She’s hardworking and intelligent. But this is the status quo for your top money managers. And I can guarantee this is the general thinking and approach many other money managers are taking with people’s money, yours included.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

My Energy and Capital Portfolio Compared With Top Money Managers

According to Baird Asset Management research, an outstanding performance by a money manager equates to beating benchmark index returns, like that of the S&P 500, by only 1%!

That means over a 10-year time frame, a top-rated money manager is only expected to return $10,000 for $100,000 invested to be considered one of the best.

This blows my mind.

In contrast, my model portfolio, specifically the trades I have shared and advised readers of Energy and Capital over the past year to take action on, have returned on average 108%. This is across all closed trades, both wins and losses, and only excludes our open trades. Some of my colleagues here have done even better!

Of course, there’s no way I would be able to replicate such insane success every year. But I can guarantee I’ll take your money manager and their portfolio to the woodshed and whoop ’em.

The same $100,000 you could invest with a money manager over 10 years for a return of $10,000 could be leveraged into a one-year return of $108,000 in total profit! You’d double your money in a single year instead of gaining one-tenth of your money over a span of 10 years.

The choice is simply a no-brainer.

Ditch your money manager and keep acting on the trades we offer. You won’t be disappointed!

Speaking of which, take 31% today on our Capital One Financial Corp. (NYSE: COF) trade that I recommended back in February 2021 (if you acted). The bank rally has stalled.

And make sure you check out our latest investing idea for 2022 too!

To your wealth,

Sean McCloskey

Editor, Energy and Capital

After spending 10 years in the consumer tech reporting and educational publishing industries, Sean has since redevoted himself to one of his original passions: identifying and cashing in on the most lucrative opportunities the market has to offer. As the former managing editor of multiple investment newsletters, he's covered virtually every sector of the market, ranging from energy and tech to gold and cannabis. Over the years, Sean has offered his followers the chance to score numerous triple-digit gains, and today he continues his mission to deliver followers the best chance to score big wins on Wall Street and beyond as an editor for Energy and Capital.

@TheRL_McCloskey on Twitter

@TheRL_McCloskey on Twitter